LIC’s Financial to own Pensioners contact the financial requires regarding retired people, letting them get casing finance not as much as certain, pensioner-amicable conditions. So it step means decades will not be a boundary so you’re able to owning a home, getting retired people with the chance to safer their fantasy home during their wonderful age.

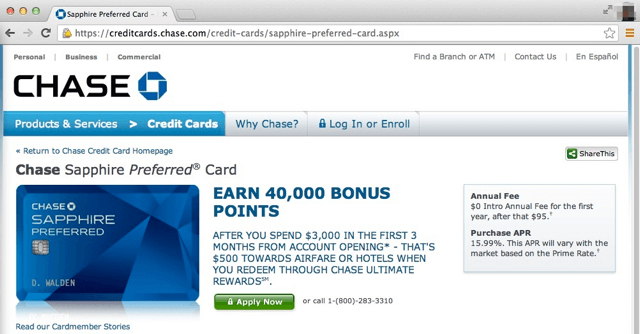

LIC Mortgage Handling Payment

LIC Lenders include a clear percentage construction, together with a moderate operating percentage. While you are prepayment charges get apply not as much as specific criteria, LIC ensures that borrowers are well-told on any appropriate fees initial. That it openness on percentage build assists with and work out an educated choice when choosing LIC for home financing demands.

By using the LIC Home loan EMI Calculator to own Energetic Think

Active monetary thought is vital whenever opting for home financing. The fresh LIC Financial EMI Calculator is actually a tool designed to assistance people into the knowledge its monthly payments otherwise EMI into the financing. By the inputting the mortgage count, the newest tenure, in addition to interest rate out-of 8%, anybody can be estimate their mortgage EMIs, providing them to evaluate their fees capability correctly. Which tool, supplied by LIC Housing Money Limited, assists with thought the fresh new money greatest, making certain that brand new housing finance organization’s financing doesn’t end up being good burden.

The applying Procedure to own a great LIC Financial

Obtaining a beneficial LIC Home loan concerns a simple procedure. People have to fill out a properly filled application with each other to the needed documents into the nearest LIC Homes Money office. The procedure is customers-friendly, made to be because effortless and you will problem-free as possible, making certain that people can be safer their property financing easily.

Step-by-Action Guide to Trying to get a beneficial LIC Home loan

- The first step in the obtaining an excellent LIC Home loan was so you can fill out the application, offered at LIC Houses Finance offices otherwise on line.

- Following software, individuals need to submit the mandatory data files, and KYC records, earnings facts, and property data files.

- Just after submitted, LIC process the application form, conducts the necessary confirmation, and you will up on acceptance, the borrowed funds count is paid.

LIC Mortgage Files Necessary

- KYC documents, such as for instance Aadhar Card and you can Bowl Card, to confirm its identity.

- To own salaried individuals, income slips about past half a year and you will income tax efficiency are essential.

- Self-employed some body must complete tax yields and financials having care about-employed, showcasing the money over the past 1 year.

- At the same time, property data files regarding the property are purchased otherwise developed are needed seriously to finish the app

https://paydayloancolorado.net/stonegate/

To make an educated Choice: As to the reasons Prefer LIC for your house Loan

Opting for LIC for your home mortgage also offers multiple advantages, along with competitive interest rates, full loan selection, and you can advanced level customer service. That have ages of experience in the houses finance business, LIC Casing Funds Limited really stands due to the fact an established and you can respected spouse getting fulfilling your property money means, making it a fantastic choice to have potential housebuyers into the 2024.

The future of A home loan that have LIC Home loan Plans

Looking in the future, LIC Property Fund is set to transform a mortgage. Having innovations like on line software techniques, offered financing tenures, and you can options for a shared applicant, LIC was and then make mortgage brokers even more available and you can smoother. The long run pledges much more custom mortgage options, catering with the diverse needs out-of individuals, and additionally those people generally noticed a high risk, such as for instance individuals paid in cash. This forward-thought means ensures that LIC will continue to be the leader in the house financing sector.

Finishing Applying for grants LIC Mortgage Rates of interest

The competitive side of LIC financial rates of interest lies maybe not simply from the quantity in the flexibility together with range out of loan plans provided. Out of offering several of the most glamorous cost in the business in order to delivering alternatives for dealing with a great loan, LIC provides showed the dedication to helping some one and you will parents see their ground regarding the property industry. It adaptability and buyers-focused strategy are what put LIC aside regarding the packed industry out-of a mortgage. The even more Mortgage guidelines, you can visit Jugyah, where we are offered at each step of your house purchasing/rental excursion.